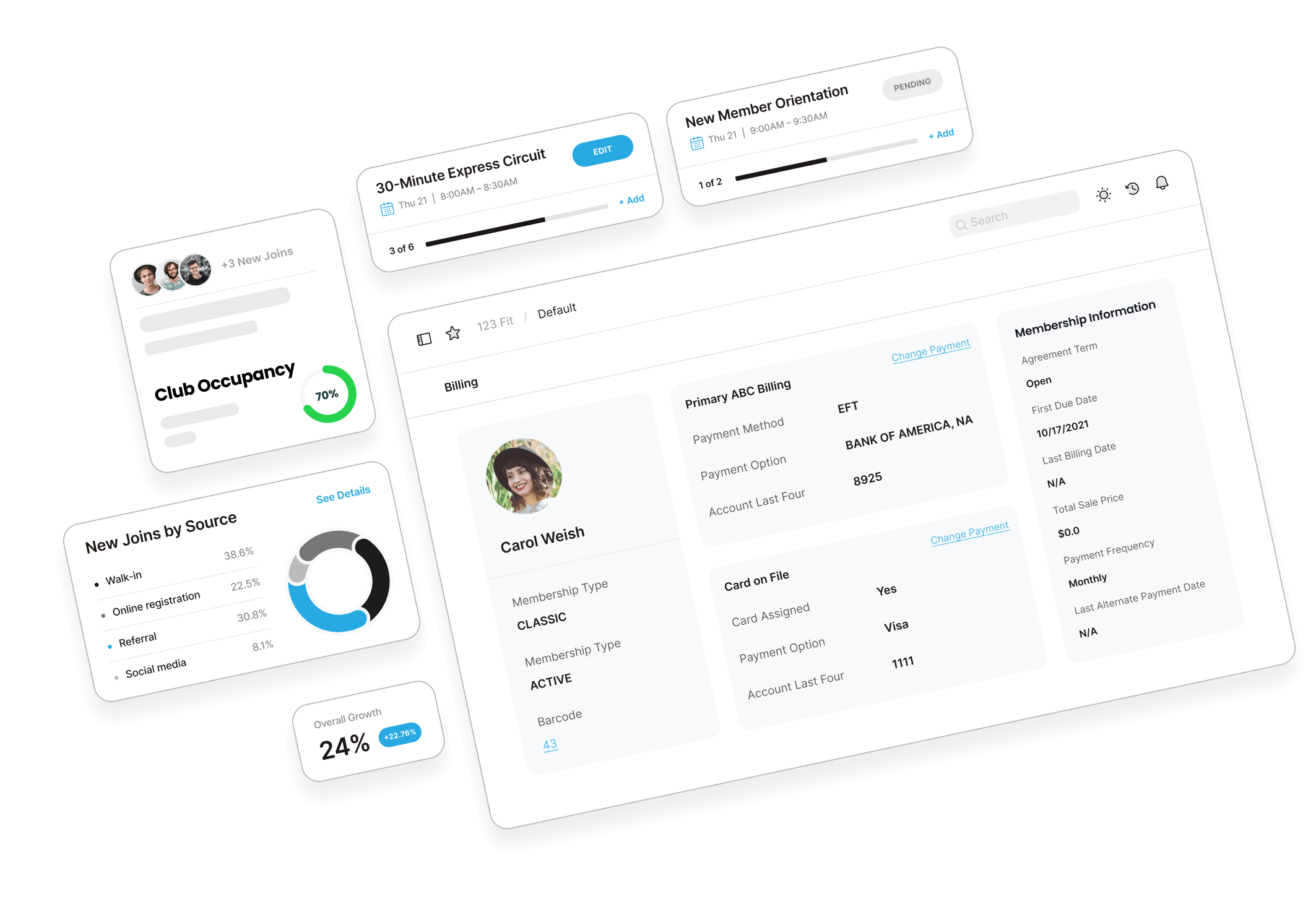

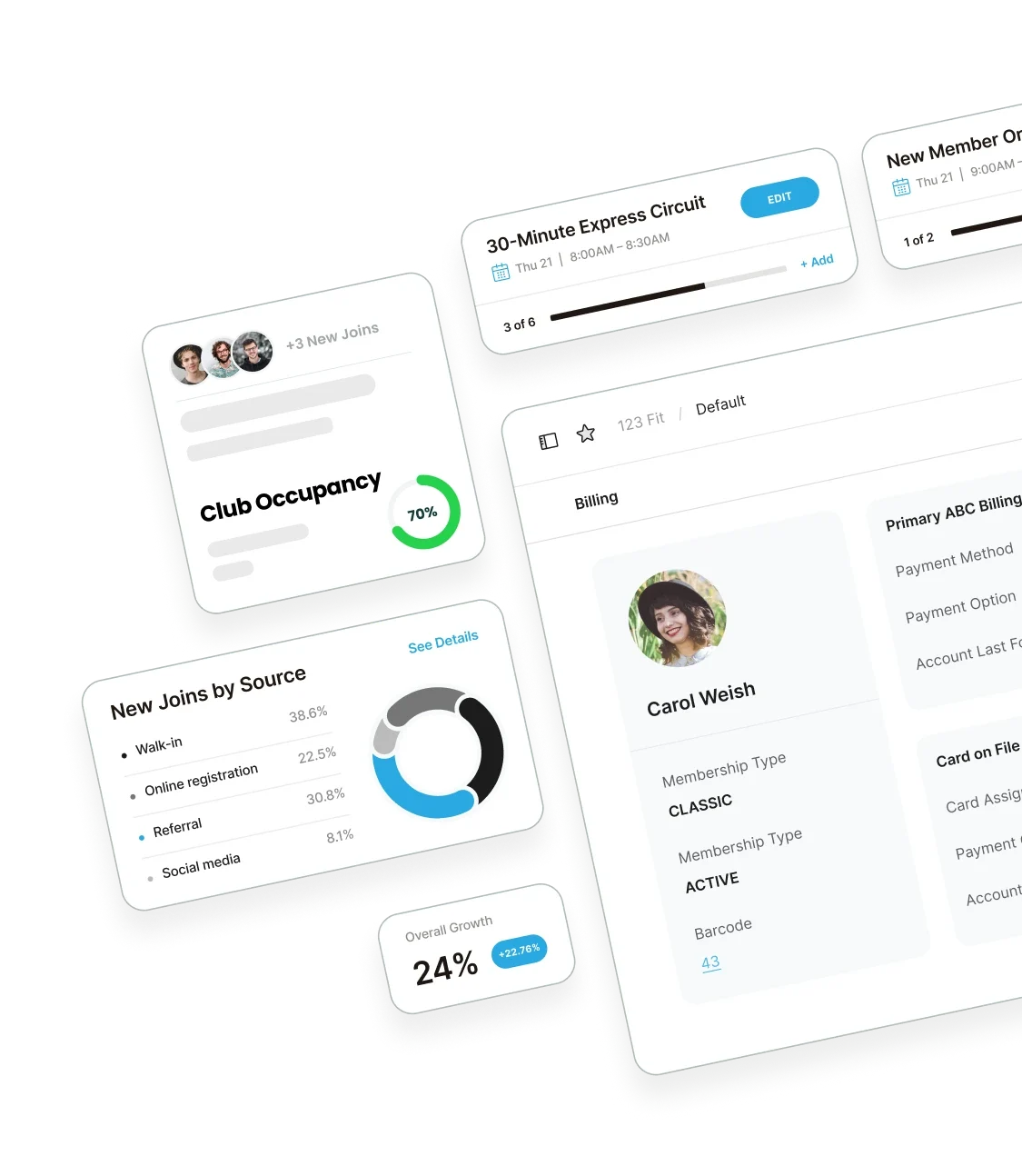

#1 club & gym management platform

Grow your gym 30% while streamlining sales, member engagement, and operations.

Get the latest from ABC Fitness with our newsletter

By providing my email address, I agree that I am the owner of such email address and that I would like to receive communications from ABC Fitness Solutions, LLC and/or its affiliates, which may include service related, informational, or marketing content. I acknowledge that I am not required to provide this consent, directly or indirectly, as a condition of purchasing any goods or services.

I understand that I may unsubscribe or opt out of receiving these messages at any time.