Why PCI Compliancy is Important

By: Margaret Payne

Product Marketing Manager

PCI Compliancy is required for any business, regardless of size or number of transactions, that accepts, transmits or stores any cardholder data. Said another way, if any customer of that organization ever pays the merchant directly using a credit card or debit card, then the PCI DSS requirements apply.

The Payment Card Industry Data Security Standards (PCI DSS) are requirements to ensure that ALL companies processing, storing or transmitting credit card data information maintain a secure environment. The focus is to improve the security of sensitive customer information.

What does it mean to your club that ABC is a certified PCI Compliant company?

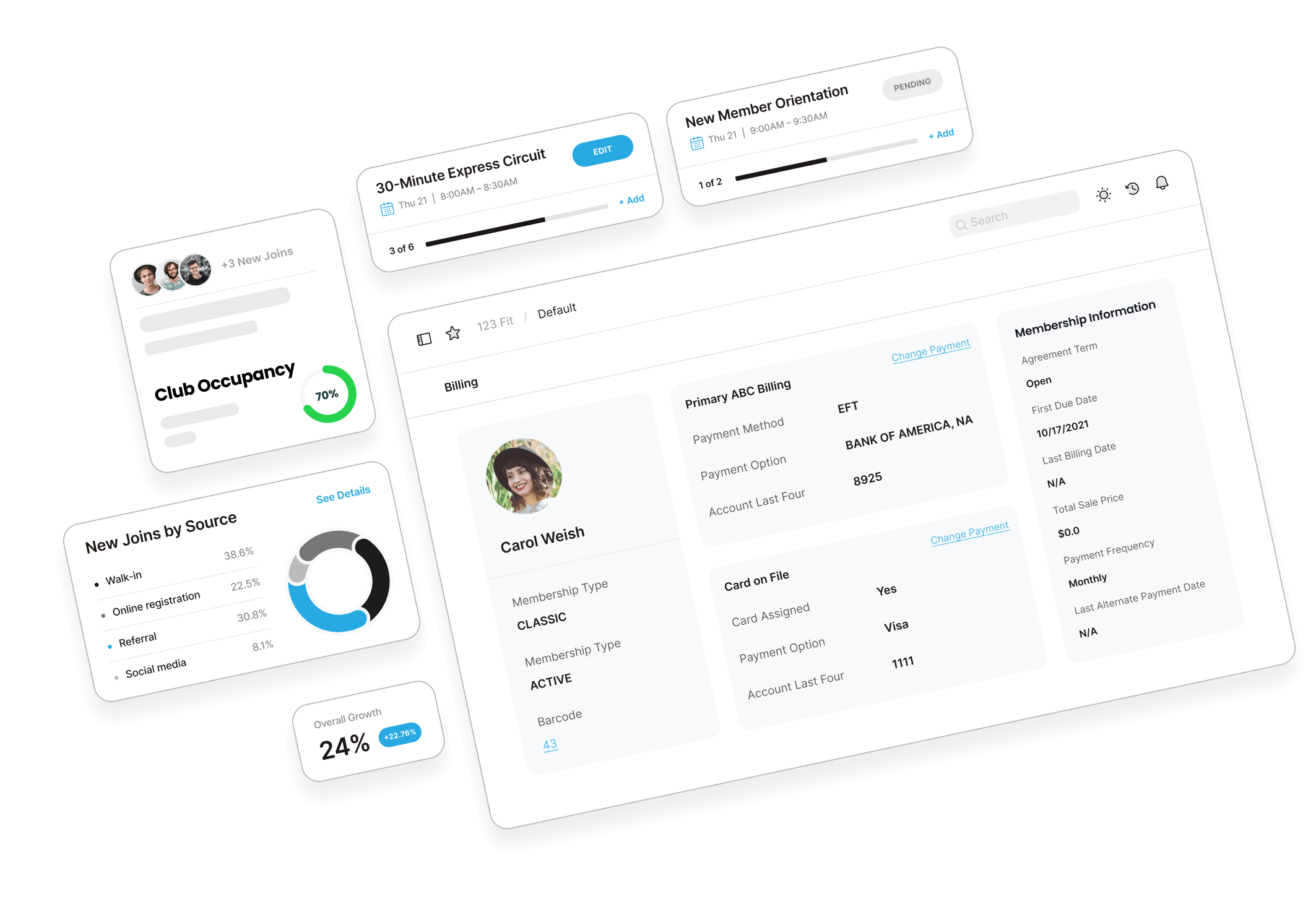

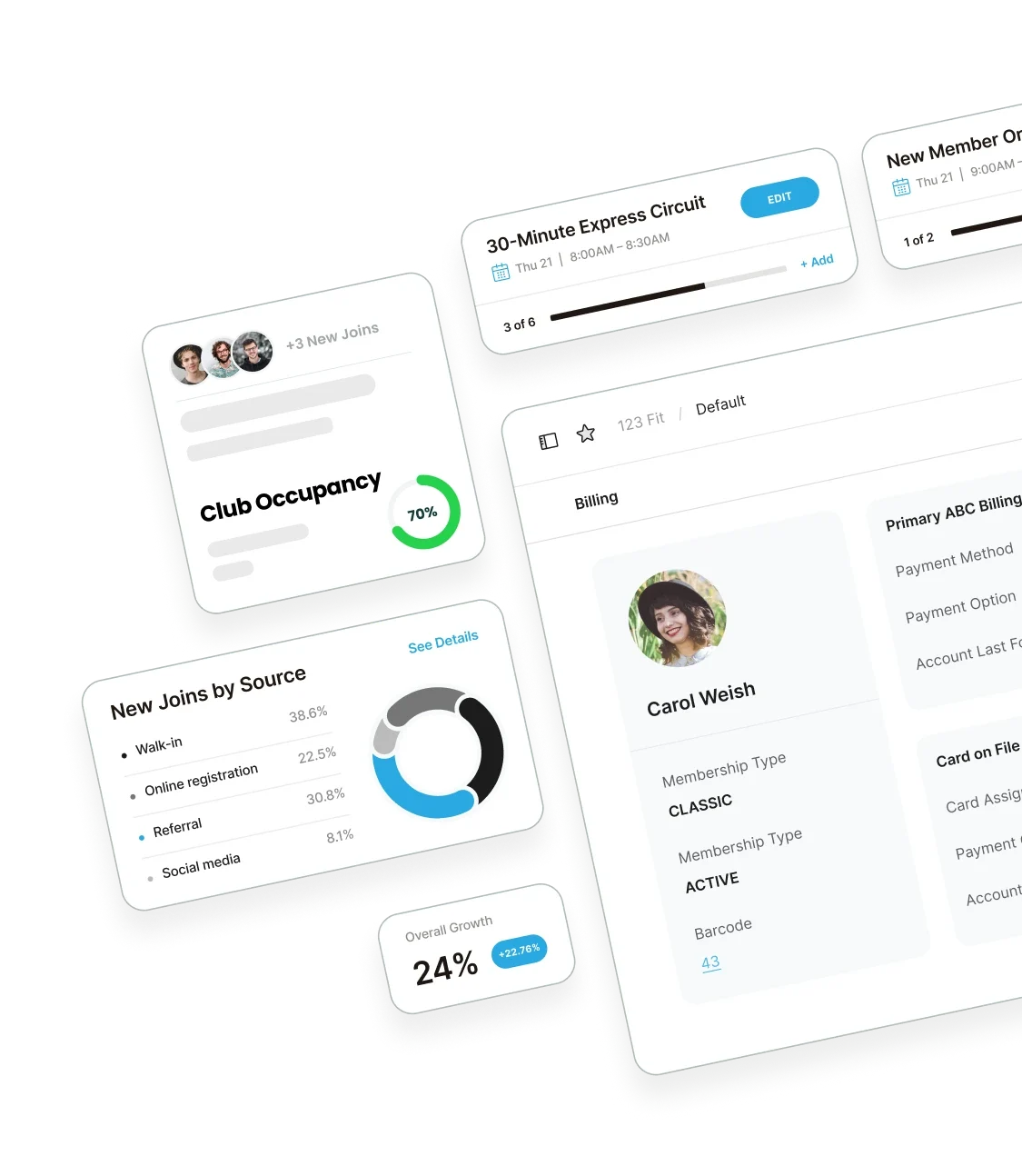

ABC does the majority of the heavy lifting, to make it easier for you to become PCI Compliant on the club level. ABC provides the maximum security for your member’s credit card and banking information. This is the encrypted sensitive information that is housed within the DataTrak and MYiCLUBonline software. In fact, ABC is constantly evaluating and updating our product and service offerings to ensure we are doing everything to give you peace of mind!

What do you need to do to become PCI Compliant?

ABC has partnered with Trustwave to help you understand and navigate the process of achieving and maintaining PCI compliancy for your club. By taking the time to become PCI compliant with Trustwave and ABC, you are granted up to $50,000 breach protection per incident if information is compromised.

Begin today by completing these key items and stay one step ahead in your efforts to become PCI Compliant:

1. Register at Trustwave using your Merchant ID number(MID) pci.trustwave.com/abcfinancial. If you are unsure of your status, you may contact Trustwave at 877-815-3414 or ABC Financial at pci@abcfinancial.com for more information.

2. On the Trustwave website, fill out the SAQ (Self-Assessment Questionnaire) that represents your practicing business model*

3. Quarterly, have an Approved Scanning Vendor perform the required Internal Scan. Approved vendors can be found using the following link:

PCI Security Standards

4. Quarterly, have an External Scan performed using the Trustwave TrustKeeper Agent available on the Trustwave website.

5. Follow PCI Best Practices

- Creating a Incidence Response Plan

- Logging ALL visitors in and out of the club

- Marking out the credit card number on paper documents

- Proper disposal of paper and electronic documents with sensitive member information (i.e. shredding, pulping, incinerating, etc.)

*Depending on your current business model, there may be additional items to address for compliancy.

Here is how ABC can help you become PCI Compliant

ABC understands that this can be an overwhelming process. We have created a series of guides to assist with the breakdown of the SAQ Questionnaire. This guide does not give a right or wrong answer; it simply helps you to know which answer applies to your clubs current practices.

What happens if you do NOT become PCI COMPLIANT?

Having a certificate of compliancy is a validation to your customers as well as the card brands that your company is doing their due diligence to protect all sensitive and confidential customer information. As your partner, ABC realizes that your time is valuable and gives each club 6 months from the first credit card payment processed or provided as documentation to complete the compliancy process. If you decide not to take the necessary steps or show your due diligence in becoming PCI compliant, ABC will begin charging a nominal fee of $49.00 per month until compliancy has been addressed and passed.

ABC is dedicated to help ALL our clients achieve PCI Compliancy. If you have any questions regarding PCI Compliance, please contact Margaret Payne at pci@abcfinancial.com or Trustwave at 877-815-3414.