Are We Looking at our Industry Through “Rose Colored Glasses”?

By: Michael Scott Scudder

The term rose-colored glasses first surfaced in common language in the 1850’s and is generally attributed to English author Charles Dickens. It describes a person who has “…a cheerful, optimistic view of things, usually without a valid basis.” (Source: Random House Dictionary)

Said another way, the term denotes a refusal to acknowledge facts as contributors to an opinion on a subject. One dictionary flatly states the term as “…used in reference to a naively optimistic or unrealistic viewpoint.”

I have more than once in my career been called “Dr. Doom” or a “negativist” in my presentations on certain aspects of the health club business. Thankfully, in over 20 years of writing newsletters, far more people have acknowledged me for bringing objectivity to an industry that has often been subjectively over-hyped.

Maybe nearly three decades as a competitive individual-sport athlete (Nordic skiing, Alpine skiing, golf, tennis) tempered my outlook. The truth is that you lose more than you win. You work on your skills, only to find that in mastering many you still have others to approach from almost elementary positions. You never have more than a few minutes in the limelight.

Early-on in the health club business, I came to understand that I was fighting an uphill battle by offering exercise to the masses…when only a small percentage of them actually wanted it. It was very sobering to learn that no matter what we do…of the15%-16% of the population who participate in facility memberships, 35%-40% (or more) of them will quit every year…and have to be replaced if we want to run even a marginally-successful club.

But, even in light of some obviously irrefutable facts (attrition, lowering prices and profits, increased competition), I haven’t changed my belief that ours is an industry that can immensely contribute to society. With that in mind, today I’ll forge ahead with an editorial that some may think to be a “bummer”…and I fervently hope that more will view it as a breath of clean, fresh air.

OBSERVATION: Independent fitness facilities are getting a smaller slice of the membership pie every year…and with less revenues.

Approximately 9% of clubs in the U.S. control over 40% of national memberships. (Source: analysis of Club Industry’s Top 100 and IHRSA‘s annual membership statistics.)

Fifteen years ago, the average number of members per club was nearly 2,100…today it is barely over 1,600. A decrease of more than 20%.

In 2004, average single-member annual membership dues exceeded $450. Today, that average is less than $350. A 20%+ decline in average prices.

OBSERVATION: Large club companies (corporately-owned and franchisers) are getting big investment dollars to buy up profitable regional-chain facilities.

2014 witnessed over two dozen of these deals.

There are presently another dozen-plus deals in the making.

The appeal is cash flows. The problem is over-leveraging. Many of the “bigs” have taken on huge debt to purchase or build clubs. Eventual implosion is a strong possibility.

OBSERVATION: The game has changed but most of the players haven’t shifted gears.

For independent facilities, profits can only be made from ancillary sales.

However, the average club is only garnering slightly more than 20% of its revenues from sales of training, programs and other ancillary sources.

The vast majority of facilities still insist on an antiquated “members-only” business model.

Potential-customer outreach is mired in outdated advertising and marketing vehicles.

OBSERVATION: Profit margins continue to lower in the independent-club sector.

Just three years ago, average-independent-facility pre-tax margins approached 12%. Presently, 8% is the norm.

Profits have dropped by one-third in less than 36 months.

Nearly 30% of reporting businesses are making no profits whatsoever…operating either at bare break-even or losses.

OBSERVATION: Numbers reported by major industry publications present a distorted picture.

Articles continuously suggest that there is “…over 80% of the population” still available for health club membership.

Objective analysis of memberships purchased and memberships terminated suggests that well over 60% of available consumers have bought club memberships and decided it is not for them.

In the last 20 years, nearly 300 million new memberships were sold. At present, 53 million paying health club members. Approximately 18% retention of memberships sold since 1994.

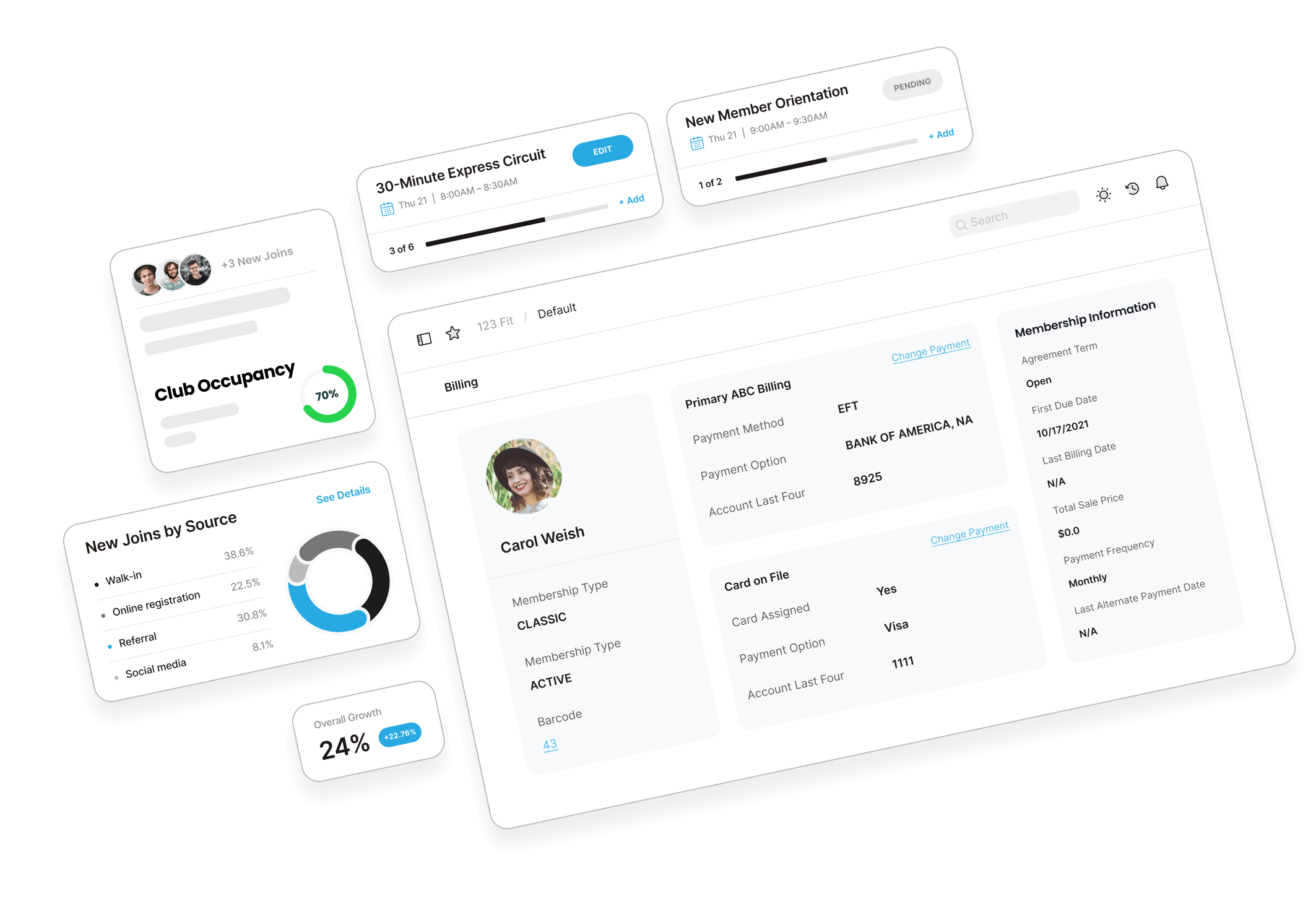

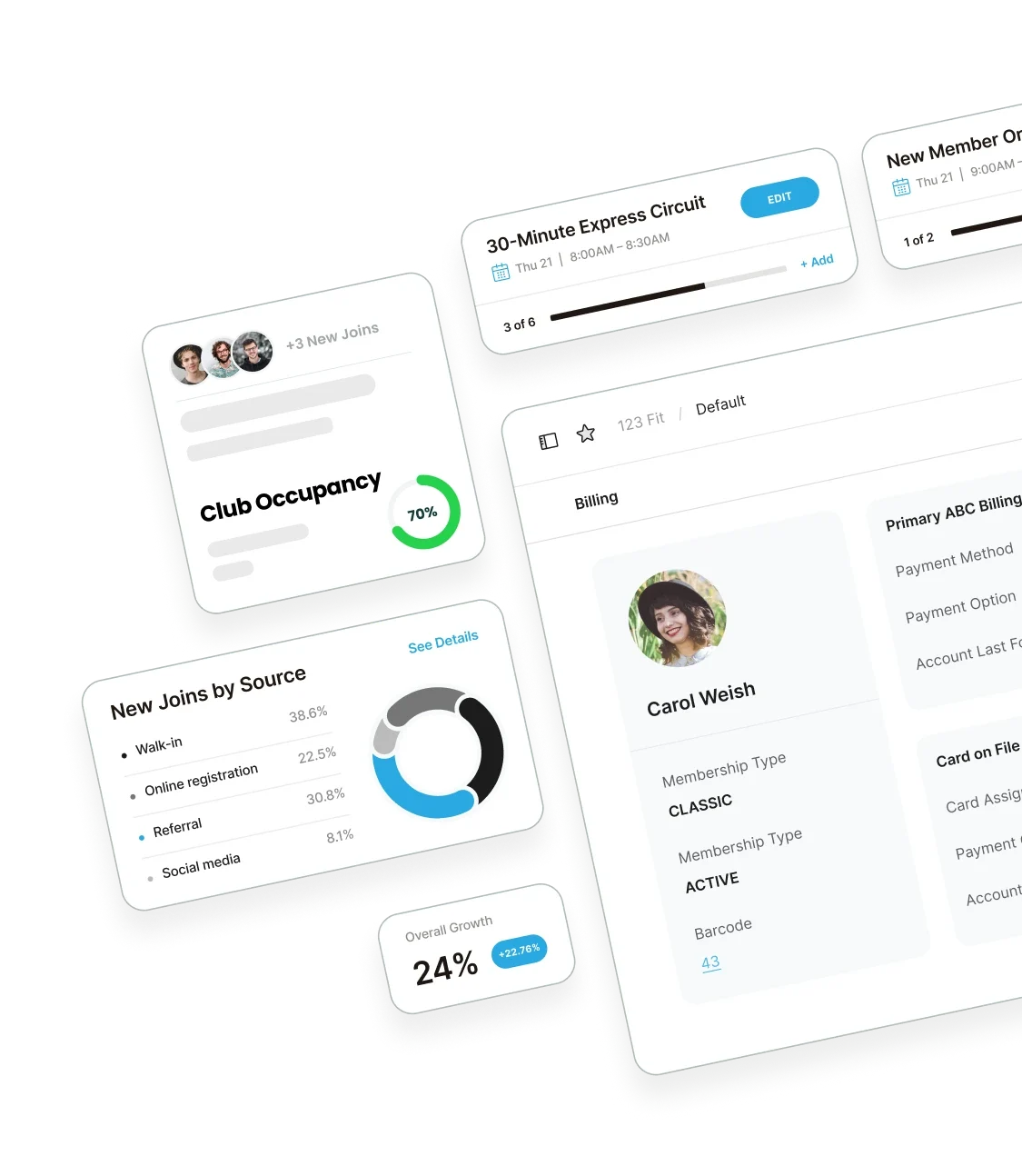

OBSERVATION: Technology adaptation and adoption are seriously lagging.

Less than 30% of facilities require a health/fitness assessment of new members.

Only 13% of clubs have a technology-based assessment system.

Only 6% of clubs employ wearable technologies to help customers “track” their exercise results.

In less than 20% of facilities can members buy, book or schedule training or classes online.

If truth be told, our industry is an entity that is now seriously behind the times in services delivery; tardy in adopting modern standards of business practices; and becoming increasingly more “Wal-Marted” each year. Even the “bigs” that, due to scale, are capable of forging ahead in the race at an accelerated pace, are predictably taking the wrong approaches to long-term sustainability (assuming that most of them even want that).

Consumer-sensitivity has not been our industry’s forte. Unless we shift and shift quickly, digitalization will obviate that consumers bypass health clubs for everyday-life solutions offered on their smartphones, tablets, and laptops. It doesn’t have to happen…but it well could.

MSS Note: In future issues, we’ll offer some solutions to the problems above.